Usually your primary home inspector will offer those services as additional options to a home inspection, but that’s not always the case. Add-on tests can cost you around $85 and up.

It’s the buyer’s responsibility to arrange and pay for any additional inspections. You’ll have to request for additional tests such as termite inspections, mold and other potential home hazards. Most home inspections don’t include additional testing. In New Jersey, you can expect to pay an average between $250 to $650. When you find a property you’d like to buy, one of the first things you’ll need to arrange is a home inspection. One thing to consider when buying a home in New Jersey are costs that will only occur during the initial home-buying and closing phase. Costs to Expect When Buying a Home in New Jersey Financial advisors can also help with investing and financial plans, including retirement, taxes, insurance and more, to make sure you are preparing for the future. NJIUA’s mission “is to provide essential property insurance to applicants who cannot secure coverage in the voluntary market.” Since it’s considered a last-resort market, the entity doesn’t seek customers and provides basic coverage only.Ī financial advisor can help you understand how homeownership fits into your overall financial goals. If you can’t obtain insurance through a private company, you can apply for coverage through the New Jersey Insurance Underwriting Association (NJIUA). In 2020, 95,473 homes in New Jersey were at risk of category one hurricane storms. Another hurricane is always a possibility, so you’ll want to make sure your property’s covered. If you buy in this state, you’ll want to shop around for insurance that will cover your property under a number of adverse conditions. In 2012, Hurricane Sandy caused $6.3 billion in private insurance losses in New Jersey. Flood insurance is covered by the National Flood Insurance Program.Īnother element to keep in mind is hurricane damage in New Jersey. Most of New Jersey’s coastline is susceptible to storm surges, so you’ll want to keep that in mind when you’re considering your coverage options. However, if you’re looking at a coastal property, which constitutes about 34% of all insured properties in the state, you’ll need to add flood insurance on top of your normal homeowners insurance. The state has an average annual premium of $1,174, according to data. The New Jersey Department of the Treasury has information on each program on its Division of Taxation website.įortunately, homeowners insurance is slightly less of a burden in New Jersey than its property taxes. The homestead benefit program is for those with income under a certain amount and the deduction is calculated per eligible property. While taxes are high, there are a few property tax relief programs, including a deduction for senior citizens, disabled persons, veterans, tax freeze for seniors and the homestead benefit program. An example of disparate taxes across the state is Cape May County’s effective tax rate of 1.51% compared to Camden County’s 3.46% rate. Each school district levies taxes as well as the municipality and county. Taxes vary between counties and cities more than you might think. Once that’s determined, New Jersey’s Division of Taxation adds an equalization ratio to ensure that the value is fair and that everyone pays a fair share. If you own a home in the Garden State, your property’s value is determined by a local assessor. The state doesn’t collect any of the property taxes everything that homeowners pay goes directly to local governments. Overall, the average annual property tax bill paid in New Jersey is about $8,796 which is again the highest in the country.Įach municipality in New Jersey has its own tax rates. Most property values are pretty high in this Northeastern state, which means correspondingly larger tax burdens. While the national average effective tax rate is about 0.99% of your home’s value, New Jersey’s rates hover near 2.26%. Property taxes in New Jersey are the highest out of all 50 states.

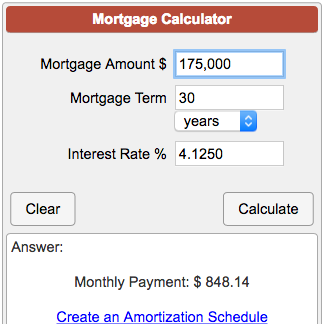

The two biggest considerations are property taxes and insurance. There are a number of additional expenses to add on top of your mortgage principal and interest payments. Factors in Your New Jersey Mortgage Payment

0 kommentar(er)

0 kommentar(er)